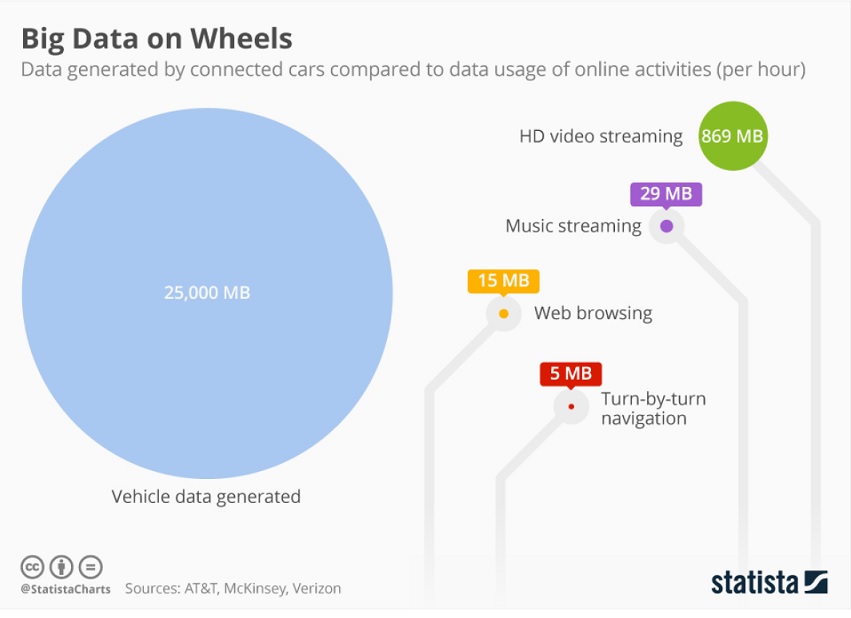

Celebrated as a “data centre on wheels,” the modern car is more software than ‘hardware’, and kicks off an enormous amount of data that OEMs are using to optimize vehicle operation and driver experience. Research firm McKinsey has counted more than 100 in-vehicle sensors that through continuous monitoring of location, component performance and driving behaviour can generate up to 25 gigabytes of data per hour, which is processed via 100 million lines of programming code with computing power equal to 20 PCs. But with the introduction of “connected car,” the data intensity of the modern vehicle is set to shift into hyperdrive as communications are pushed beyond internal systems to external objects, to other cars and to cloud-based systems that support the development of a whole new range of automotive services. Google’s self-driving car, for example, is believed to gather 1 gigabyte of sensor data per second, a 144 fold increase over the McKinsey estimate that speaks to the autonomous vehicle’s need to constantly surveil its surrounding environment. When the exchange of data between intelligent infrastructure – smart traffic lights and parking systems, connected roads, electric vehicle charging, or infotainment – and millions of cars that are in transit at any given moment are factored in, the question is begged: what kind of networks will we need to address the Big Data challenge that connected car presents?

According to Cisco, the future of automotive connectivity lies in networks that are optimized to address issues with data scale and telecom coverage, that simplify heterogeneous car systems through a single platform based on recognized standards, that are robust and which embed the security needed to ensure safety – the watchword in automotive innovation. This is a tall order that the company is working to deliver on by mustering existing networking expertise and applying this to specific challenges in an evolving automotive industry. At CES 2017, Cisco launched its vision of automotive networks in a collaboration with Hyundai Motor on the development of a new platform for the ‘hyper-connected car’, which combines networking for traditional, in-vehicle operational systems and IP based networking to link cars to other vehicles, objects and cloud infrastructure.

As Cisco director for Automotive & Connected Car Shaun Kirby described it, in building the new platform the Cisco team relied on existing IP to create an Internet backbone to support the technology that sits inside the car but also brought in components from the work that Cisco has been doing to connect vehicle to vehicle and vehicle to infrastructure, as well as IoT technology aimed at connecting vehicles to cloud. Part of the architecture will include technology designed to optimize for various kinds of WiFi or cellular connectivity, enabling the car as it moves across Canada, to switch to different modes based on availability, operational need and cost. At some points it might make sense to use lower cost WiFi, or higher bandwidth media for other scenarios like mapping data transfers between vehicles. Sometimes it may be necessary to use cellular on the fly to get immediate telematics out to the cloud or to get infotainment down on the fly: “we’re covering all the bases for the future of connected vehicles,” Kirby noted. And for locations outside large urban centres where coverage may not be consistent, Cisco has built “store and forward” capability into the networking backbone. If the car enters an area where none of the radios have connectivity, data from telematics systems may be stored until the vehicle re-enters a zone with connectivity, and then the backbone will forward this information to the telematics cloud, or wherever it needs to go.

Another key challenge in automotive networking is diversity of car systems and the resulting proliferation of protocols, which limits intersystem communications, and as well as options for bandwidth and security deployment. According to Kirby, CAN (Controller Area Network), FlexRay, LIN and other protocols can exist to connect various internal systems, such as power train and chassis, infotainment, or advanced driver assistance systems (ADACs) within the vehicle; these categories also break down into high speed and/or multi-CAN, adding further management complexity – an issue that will take on increasing weight as more and more vehicles attempt to connect to cloud support systems. To respond, Kirby explained, Cisco is “making things open, and replacing all of these proprietary networks and the wire harnesses that go with them, with a much lighter weight, standardized IP over Ethernet platform. And as we do this, we’re taking the vehicle from layer 2 in the stack out to layer 3 in the OSI model, where you can begin to do routing within the vehicle.”

In Kirby’s view, “eventually the whole industry will converge those devices to Ethernet at the edge – and when these can plug right into that backbone, it will become even more streamlined.” So instead of building APIs to connect various systems, the Cisco solution is an IP backbone that will enable automobile manufacturers to converge with IP over Ethernet standard at their own pace, one piece at a time. Kirby explained: “All of those electronic control units might have different software, different protocols and different connectivity. It all boils down to taking those different networks that might be in different cars like GM, or Ford, and creating a piece of our architecture that is devoted to IP conversion – whatever the networks and protocols are, we’ll have an IP over Ethernet conversion. Once the car has that IP over Ethernet backbone in place, it becomes possible to replace all those complex systems over time.”

An additional advantage of the IP-based approach is easy connectivity to cloud infrastructure. Today, one of the more popular cloud-based automotive services is telematics, which supports predictive maintenance aimed at reducing the incidence of breakdown and at rationalizing maintenance for individual vehicles. Telematics can also inform better auto design: data on how car owners use different car features may help manufacturers improve their assessments of how to improve vehicle reliability and safety. But for Kirby, this is just the tip of the iceberg – replacing costly monitoring dongles with in-car sensors, for example, may drive the emergence of new “pay as you drive, or pay as you drive” insurance models that are offered by the automakers themselves. Third-parties innovators may also enter the industry with the delivery of infotainment microservices, where drivers might pay pennies for a game or to access to an article. Cisco itself, will provide collaboration services, including videoconferencing, to make people more productive – including drivers who will have more free time as cars become increasingly automated.

In Kirby’s view, the range of services that can be delivered though Big Data analytics powered by cloud is limitless, and Cisco is working right now with a partner who is creating the foundation for an “Automotive Cloud.” As the connectivity platform develops and as the number of connected vehicles – i.e. demand – grows, he expects that the list of features will expand dramatically: “We are at a rudimentary stage with this Automotive cloud. There are working examples but they are limited compared to what we will see very soon.”

In Kirby’s view, the range of services that can be delivered though Big Data analytics powered by cloud is limitless, and Cisco is working right now with a partner who is creating the foundation for an “Automotive Cloud.” As the connectivity platform develops and as the number of connected vehicles – i.e. demand – grows, he expects that the list of features will expand dramatically: “We are at a rudimentary stage with this Automotive cloud. There are working examples but they are limited compared to what we will see very soon.”

If Cisco is pushing a unified approach to in-vehicle and car to cloud communications, the reality of the automotive industry today is highly competitive design and marketing from multiple global manufacturers and the need for connectivity with millions of IoT devices tomorrow. To reinforce the notion that vehicles running the Cisco networking platform will be able to connect with others on the road as well as smart infrastructure, Kirby pointed to Cisco participation in the work of various standards bodies and how this effort will benefit an emerging connected car ecosystem: “We are pretty active in pretty much all of the major networking standards bodies – the IEEF and IEEE – and we’ll continue to be active in these. I think we will see more activity around the definition of standards for vehicle to vehicle or vehicle to road, as well as the standards for in vehicle networking. We are really doubling down on our investment in those standards bodies to encourage the industry to come to a common standard that will benefit all the players. We’re also focused on creating an open architecture – so no proprietary technologies in the vehicle. We really think that if we lay the right foundation, the ecosystem will develop organically in a way that is good for everyone.”

With total interoperability, however, comes the question of differentiation. Cisco is not alone in building a smart vehicle platform – players range large integrators such as Accenture to providers like BlackBerry who have established leadership with OS solutions like QNX, to other large IT vendors such as Microsoft, which also launched its Connected Vehicle Platform at CES in January, to specialty providers with long heritage in the automotive industry. For now, Cisco’s focus is on automotive networking, a positon that Kirby argued is bolstered by the technical capabilities the company has developed in the enterprise space over time: “We have proven ourselves leaders in the scalability, robustness and flexibility of our large enterprise networks and we want to do the same thing for the vehicle. But first and foremost for us is security. We are really doubling down on security in all of our technologies, and where we want to differentiate in the vehicle to vehicle, vehicle to object, vehicle to cloud spaces is to be a leader in the development of secure, connected vehicle solutions.”

This stance makes considerable sense, given the additional risk associated with connected car solutions. While the consequences of security failure are catastrophic and may include loss of life, as per Allen’s dictum, which argues that IoT risk varies directly with the number of nodes on the network, connected car introduces a vastly increased attack surface. Each time a car connects with another vehicle or object, new risk is introduced, a situation that could be exacerbated through the use of open systems and technologies. As in networking, on the security front as well Cisco intends to apply approaches that have been hardened in enterprise solution scenarios. According to Kirby: “We are going to apply our same security approach, where we look at all the possible attack vectors in the vehicle and we secure them to the best [level] that we in the industry can achieve. We are also going to be preparing our cloud: we have a three stage philosophy of being prepared before an attack happens, being prepared to terminate it quickly when it happens, and recovering quickly. And we’re also going to be applying the same security technologies to beef up the security of our network for IoT. It’s not an easy challenge, but one that we have been paving the way for for a number of years – perhaps the connected vehicle will become the ultimate IoT connected device.”

Beyond this general statement, Cisco intends to focus on ensuring security standards in its own supply chain, and to leverage its Talos Security Command Center team, which monitors a broad range of networks globally and can inform ecosystem partners of mass threats to help them quickly secure their devices, in doing so. And in cases where the device fails – many low power IoT sensors do not have security built in – Kirby points to the in-vehicle control that the networking platform can provide: “The backbone provides us with the central point of control within the vehicle – all traffic will go through this, and we can inspect it, we can firewall it, and apply smarter and smarter rules to it. There are indeed constraints on edge devices, and here we’ll be looking at everything from edge protocols to advanced technologies. One of the secret weapons is an acquisition that we made a few years back called Data in Motion, a highly intelligent, embedded software that can be installed in devices at the edge and play a role throughout the network in the vehicle. It does everything from intelligent learning compression to deep packet inspection and analysis of network to prevent threats from the edge or from devices in the ecosystem.” And through its acquisition of Jasper, the company is also able to define very granular policies on the usage of these vehicles, and even of devices within the vehicles and their communications to the cloud – an additional security measure that Kirby noted parenthetically may help to protect vehicles still on the manufacturer’s truck that have proved vulnerable to illegal (and expensive!) download of gigabytes of content from the car interface.

Will Cisco’s differentiation on security, convergence and network stability set it apart as a winner in this emerging space? Stay tuned for more on new activity and innovation in connected car markets.