A convention in the cloud war narrative is runaway dominance by one cloud service provider, namely AWS, crowned leader in public cloud delivery markets by the analyst community for many years now. Signs have begun to emerge, though, pointing towards a chink in this armour. Rapid delivery growth achieved by other providers, the evolution of cloud services companies with specialized offerings, and local market attributes each contain potential to alter mainstream market assessments going forward. Recent cloud news from Canada offers an interesting perspective on this issue.

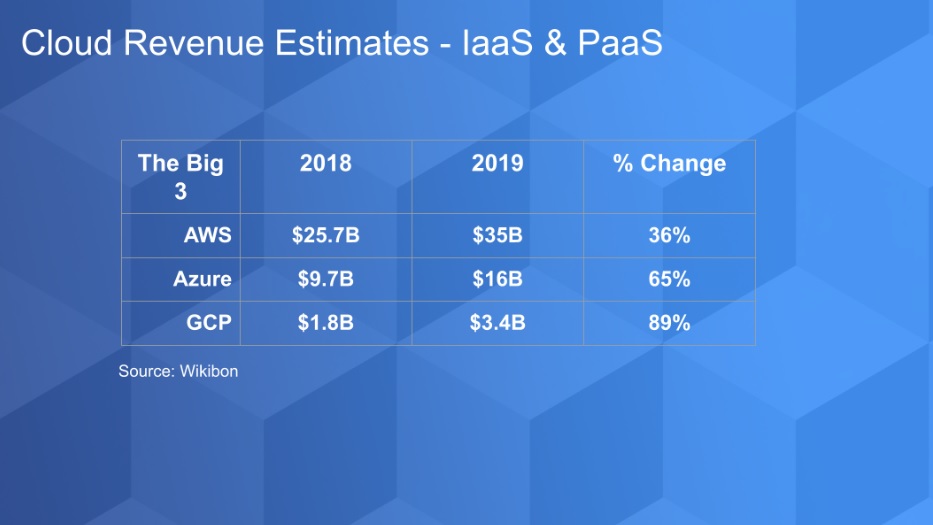

Recent market sizing research tells a familiar tale. Based on cloud market data developed by Wikibon and Enterprise Technology Research, Wikibon analysts Dave Vellante and Mike Wheatley have ranked the top three public cloud providers by y-o-y revenue for 2019 in the usual way: as shown in the Wikibon figure below, AWS dominates global cloud markets, followed by Microsoft and Google Cloud. Perhaps more telling than rank, is rate of growth. If rates of change calculated below continue into the next year, Azure revenues shift from slightly less than half that of AWS to slightly more.

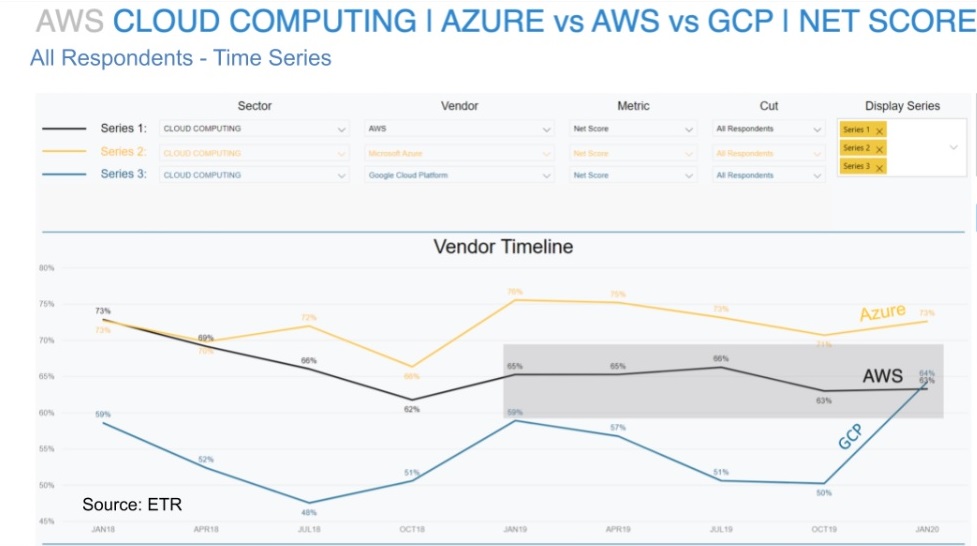

According to Wikibon analysts, a telling indicator of spending growth going forward is found in ETR’s Net Score, a “measure of spending velocity that takes into account whether a customer is planning to spend more or less on a particular vendor.” Except for very large enterprise customers (Fortune 500), Net Score shows especially high performance for Azure (since 2018) and recent momentum from Google Cloud, which is moving GCS to a position that rivals AWS in terms of customer intentions.

Market data analysis is an imprecise science. Based on educated guestimates, the data tends to suggest a direction rather than reveal truth, and conclusions are rightly couched as estimates by analysts with greater or lesser finesse derived from relative amounts of research resource and rigour. But when seasoned observations based on long term industry study are taken into account, these insights can reinforce the data story. For example, in a recent televised interview, Morgan Stanley analyst Keith Weiss also attributed Microsoft ability to achieve parity with AWS to its strength in customer relationships, and to an “enterprise pedigree” that enables the company to “solve mainstream business problems,” unlike AWS, which has heritage with “hard core engineering groups” focused on solving technical issues.

Microsoft Canada expanding capacity

The story of cloud growth also comes from the horse’s mouth. This month, Microsoft Canada announced that it is making significant investments in the expansion of cloud computing capacity in the two Azure regions that make up the company’s Canadian geography. Specifically, Microsoft is creating Azure Availability Zones in its Azure Central region, which provide will provide high availability for demanding applications and services and protection from potential hardware and software failures. As Henrik Gütle, GM for Azure at Microsoft Canada, explained, this investment was driven by customer demand for high availability combined with disaster recovery: “High availability is our highest level of offering where we have multiple data centres within a region, providing customers with four nines of uptime. We are very excited about being a part of bringing this to the Canadian market – it is no small investment as you can imagine.” To ensure redundancy, each Microsoft region has two data centres with discrete physical locations: in contrast, high Availability Zones require at least three unique physical (facilities) locations per region. According to Microsoft, this addition will position the company as the only hyperscale cloud provider in Canada to offer Availability Zones and disaster recovery with in-country data residency, and high reliability – SLAs of 99.99% for virtual machine environments deployed in Availability Zone configurations.

In addition to the Availability Zones, Microsoft is also investing in the creation of additional capacity that will come online in the Eastern Region in the first half of the year, and adding a new Azure ExpressRoute site in Vancouver (live March 2020) to existing ExpressRoute sites in Toronto, Montreal and Quebec City. A private connection back to Microsoft cloud services, ExpressRoute allows customers to circumvent the public Internet, while connecting to Canadian or US data centres with faster speeds, greater reliability and more consistent latencies.

Growth drivers

All told, these announcements represent a 1300% increase in the company’s infrastructure capacity, as compared with Microsoft capacity that was available when the company’s two Canadian cloud regions launched back in 2016. Gütle attributed this considerable expansion to growing customer demand. “We are seeing tremendous uptake of our Azure offering in the Canadian marketplace. We see it cross country, and we see it in customers of all sizes – all the way from the largest financial institutions to small businesses and startups and we are seeing it across industries as well.” In each sector, he added, growth in demand is fueled by different things. For example, the financial sector is the first to be exposed to digital transformation, and hence is adopting cloud more rapidly than other industries. Another area that Gütle is seeing increased velocity is retail, as retailers transition to online services and sales. Momentum is also growing in the resource sector, and in oil and gas specifically, while government is creating the structures necessary for broad scale adoption.

“Government, and public sector in general is an interesting case,” Gütle observed. “We are seeing both federal and provincial government adopting cloud, putting the regulatory vehicles in place to enable this. Microsoft was one of the cloud providers to achieve Certification for Protected B data in Canada [which enables Federal departments to securely store, manage and process second level sensitive data and applications that “if compromised, could cause serious injury to an individual, organization or government” in Azure]. There is a lot of work that is going on in that area, so I think public sector in the next industry that is poised to adopt cloud at an increasing rate.”

In the case of government, including federal and provincial, cloud demand is driven by specific workloads. Gütle pointed to productivity tools (O365) as a starting point for many government organizations, with PRM and case management-type solutions as other important early cloud adoption areas, which feed into consolidation efforts and current government interest in shutting down private data centres. He also noted customer interest in accessing services – AI and ML – that are not readily available in most existing data centres.

According to Gütle, investment decisions are prompted by a combination of two things: “one is the anticipated growth over the coming years. Building and equipping new data centres doesn’t happen overnight, and a lot of the decision is based on long range plans and expected growth in the market. The second dimension is demand from specific customers – we are releasing new services on an ongoing basis, and the prioritization of those services is based on customer demand.” Investments, he explained are based on those customer preferences.

In Canada, it appears, cloud services have emerged as a leading requirement, and pent up demand created by laggard cloud adoption in domestic markets a key driver of current expansion. But this this assessment of local conditions begs the question, why Azure specifically? On this issue, Gütle pointed to market education activities: “The investment we announced is not just about increasing our cloud capacity and capabilities, it’s also about investing over $2 million in the development of digital skills. There’s a skills shortage in Canada, and we have put a number of initiatives in place in market to upskill over 25,000 Canadians this year.” Through programs such as Microsoft Training Days held in 10 Canadian cities, the Microsoft Ignite Tour, attended by 5,000 IT professionals and developers, and online learning through Microsoft Learn and the AI Business School, the company has focused on core cloud computing concepts, cloud migration, data, analytics, and AI, working to address needs in IT administration, cloud operation, application development and lifecycle management, as well as the business skills needed for digital transformation. According to Gütle, training efforts are eased by platform familiarity: “One of the advantages of Azure is that a lot of the tools that IT administrators, professionals are used to using in their main data centres – that toolset translates into the cloud. So a lot of the skills are transferrable” – an advantage that Morgan Stanley analyst Keith Weiss referenced in his “enterprise pedigree” characterization of Microsoft as a company that has worked to solve a variety of enterprise challenges over time with familiar tools.

Channel penetration

Familiarity with the platform is not limited to enterprise IT. In its 2020 US Channel Partner Survey Techaisle Research, asked 902 SIs, VARs, SPs, MSPs, and IT Consultants about their cloud businesses, producing some interesting insights into partners’ relative focus on different cloud platforms that is likely to have impact on adoption going forward. According to Techaisle chief global analyst, Anurag Agrawal:

- 68% of channel partners have in-house technical expertise in Microsoft Azure (including AWS and GCP partners who have developed skills for migration and management from and to Azure)

- 53% in AWS

- 48% in GCP

- 13% in Red Hat OpenStack / OpenShift

- 53% of partners have MS Azure as their vendor partner.

- 57% of cloud platform business comes from Azure and those who have partnered with all three cloud leaders – Azure, AWS and GCP – 36% of business comes from Azure

- Partners are increasingly investing in and delivering hybrid solutions. 63% of channel partners are developing skills and technical expertise in Microsoft Azure as compared to 60% in Google Anthos, 49% in AWS Outposts, 21% in Cisco CloudCenter and 19% in VMware vCloud Suite / Tanzu.

When asked why they are gravitating towards Azure (not all partners have relationships with AWS and GCP), survey respondents provided a range of answers that speak to Microsoft focus on programs that will support partner success, such as

- Proactive engagement, a powerful and extensive Microsoft ecosystem, including local technical user groups, and broad product portfolio

- Marketing resources, technical resources, lead generation support, educational incentives, migration, financial, and credit incentives

- Access to TSMs, account managers, solution architects who assist by easing customer conversations, or driving the design of customer solutions

- Customers are typically already Microsoft users, and Microsoft brings customers.

Ultimately, Agrawal noted, “Azure partners find AWS very confusing,” an observation that suggests prospects for partner led cross cloud deployment is unlikely.

Techaisle findings are especially telling in the Canadian context. The needs and priorities of large US enterprises that have the internal resources needed to navigate technical complexity and forge direct links to the cloud, are reflected in ETR’s Net Score referenced above. The Canadian IT market, on the other hand, is heavily influenced by the large number of small and medium businesses that are the country’s primary economic engine, but which lack extensive IT expertise, and hence rely on the help of the trusted channel partners to plan for, implement and integrate new technologies into their business processes. The Techaisle data which shows that the partner community is making greater investment in Azure skills, certifications and business suggests that the Canadian cloud market may follow a path that is different from that suggested by the experience of large US firms. As such, it speaks to the shape of future Canadian cloud market penetration and use, in addition to the potential for shifts in vendor positioning in global mainstream cloud market expansion.