Women do things differently – out of necessity, and to their credit. And nowhere has the “mother of invention” been greater than in the world of tech innovation. According to a study of 900 Canadian tech firms published in the fall of 2017[1], women accounted for just 5 percent of CEO roles, over half of respondent firms had no female executives, and 73 percent had no women on their boards – even though research elsewhere has found that companies with the highest share of women directors outperform those with the least by 53 percent[2]. In comparison with corporate Canada as a whole, where women account for 15 percent of CEO’s[3], the tech sector is playing a dreary game of catch up, looking to match performance on gender equity in leadership where little exists.

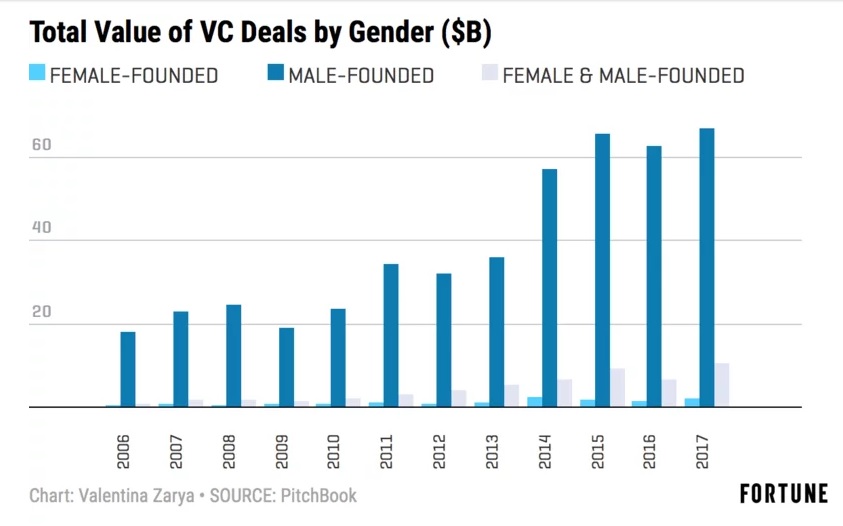

In response to the glass ceiling and other systemic challenges to female advancement, many women have embarked on the path less well travelled – one with greater risk and greater potential reward, which is the establishment of their own businesses. But if more women are seeking the independence that entrepreneurship can bring (for every hundred males, there are now 92 females in Ontario[4]), support for female-led startups sports the most grim stats: women entrepreneurs received less than 3 percent of available venture funding last year[5], an outcome that is likely influenced by the small share of female VC partners – 12 percent in Canada.

But where there is need, there is also invention. Consider The BIGPush, a Toronto-based business accelerator that helps early stage, female-founded technology companies secure investment to move to the next level of growth. Over the last several years, several organizations have emerged to focus on funding challenges for women, while others provide educational and networking services. Based on an ‘equity-for-service’ approach, The BIGPush has launched a unique, hybrid model that combines elements of each, a one-stop-shop method that combines funding support, and what BIGPush founder and CEO Sharon Zohar calls “roll up your sleeves” input from senior female executives who provide “sweat equity.” With an executive team (13 and counting) that spans multiple disciplines, including legal, PR and communications, finance, marketing and bus dev who contribute time and funds, The BIGPush operates more as a collective than a traditional incubator, with the specific aim of bringing female founded, tech-enabled businesses to a level where they are fit for Series A funding.

The kernel

Less than a year old, The BIGPush was established with some financial support from corporate sponsors, and from government, which offered more modest input as the organization is for profit. But the primary source of funding has come from female execs who were committed to the enterprise. As Zohar explained, “The beauty of what is happening in our current state is that there’s a lot of give going on… And as our management team grew, it became a great chasm of women opening up to us, who wanted to be part of this initiative. Women who would provide their time at this point with an eye to seeing future gain as successful startups began to gain traction, and who looked forward to having an opportunity to sit with the management team and see our future growth together.”

Currently in soft launch as it builds out its network of female executives, The BIGPush intends in the coming year to expand its network of senior level executives, and to build (and close) its own fund to support the initiative as lead investor, and to generate additional capital to support female entrepreneurs. It also plans to expand the list of portfolio companies are on already on board and to build out more of the program to help female entrepreneurs reach Series A level funding. Further down the road, Zohar expects to establish a non-profit arm to support the organization’s mandate with influx of a second level of expert resources who have additional specializations.

How does it work?

The ‘service for equity’ model begins with women executives who are not necessarily volunteers, but who have agreed to provide their time and expertise to help launch female startups, in exchange for an equity stake in The BIGPush, which ranges from 3-5 percent. As part of the founding team, these execs have made a commitment to the organization to provide a minimum of 15 hours a month to support the startups through their scale up. In addition to time and expertise, these execs are also making a financial investment: “they have some skin in the game,” Zohar noted, which qualifies them as part shareholders in The BIGPush. In return for their contributions, the execs receive additional benefits. As Zohar explained, “They have all come on board because of the mission and the mandate of the organization, but they also get opportunities for networking, to build up their own organizations and companies. We receive lots of engagements and sponsorship opportunities, where they can speak about their expertise and their company, so participation opens a wide door for them to build their own networks too.”

To qualify for the 6 – 9 month program, startup companies must have a product in the market, have a demonstrated lift that might look like $10,000 MMR in terms of revenue, or a larger network that can support it, and the product or service must be technology driven or enabled. The company must also have a female lead, not just a woman in the C suite, but a founder who is driven by a passion for what they want to do, Zohar added.

Companies that are accepted into the program are treated individually as needs are unique. The BIGPush team will engage with the startup to assess needs, and then do a deeper dive to develop a strategic and tactical plan that will take the company from current state (ex. $10,000 MMR) to a larger metric that will get them in the door of larger seed rounds or Series A discussions. Needs could be for marketing, legal, fund raising with some extra PR, and are valued according to the professional services that will be delivered. Typically, The BIGPush team finds that they will have to put approximately $150,000 on the table in professional services to actually move the dial, to push companies to where they need to be in order to be suited up for Series A funding. “Sometimes it’s a little more, sometimes it’s a little less,” Zohar explained, “but that’s the sweet spot in terms of where we engage with the services we provide. That exchange could be a convertible note, an equity exchange, a warrant – we work with the companies to make sense of what they are doing, and so that it makes sense in terms of how we can come on board and prove valuable to them.” Once they have completed the program and reached the required metrics, The BIGPush offers companies a cheque for $250,000 to $500,000 to maintain the momentum.

In the Canadian startup landscape, there are calls for investment along the funding lifecycle. But based on her own 20-year experience as an entrepreneur – and a female builder of businesses – Zohar has chosen to focus BIGPush efforts on the seed stage: “The seed stage is where a lot of companies fall down – there’s a big gap. It’s difficult to build an app, a product or a service and put that into the market, but its doable and many people are able to build it up to a certain point. But there is that tipping point when you need to acquire resources and funds to get into the next level. There’s no way you can do everything, wear all the hats, and that’s where things get really tricky. Passion and drive is available to everybody across the board, but when you get to the stage where funding and additional resources are required and there’s a gap there, it’s a huge drop, for many female entrepreneurs.” On the other hand, Zohar noted, as their metrics grow and the organization proves itself out, many companies have greater access to Series A funding.

Describing the program, Zohar pointed to “roll up your sleeves” work as a key differentiator for The BIGPush: while there are several strong mentorship programs such as #movethedial in the marketplace today, “we write your press releases, we do your financial modelling, so that the founder can focus on those areas that they are best suited to do.” That said, the organization also delivers services designed to meet the women entrepreneur’s unique needs, including funding, education, networking and other support. Zohar cited a recent Harvard study[6] that found differences in the questions that VCs ask female and male entrepreneurs – and predictably, different funding outcomes. To address this kind of issue, the organization works to help women develop the strategies they need to negotiate male-dominated VC environments, and to circumvent potentially negative outcomes. Answering a “preventative” (female) question from a VC with a (male) “promotional” response, for example, is a tactic for dealing with systemic barriers, and, ironically, the best combination for funding success.

But The BIGPush also aims to create the kind of nurturing environment that women need to succeed. Zohar also quoted a female program participant who articulated her requirements as “a network that I can relate to, where I can find the financial, the moral and the social support to bring my company to the next level.” Beyond financial input, the organization works to provide a “whole moral and social fabric that comes from understanding the wit from the woman’s lens.” According to Zohar, many women entrepreneurs are not comfortable speaking about challenges, such as home and work/life balance or children, in front of male VCs, but “In our environment, that goes away. “We help them navigate those male-dominated spaces, and enable them to communicate concepts in a way that is as natural as their communication with women in The BIGPUsh.”

Measuring success

For The BIGPush, success is measured in a fairly straightforward way – the number of companies that are raised to a Series A position, or in cases where the startup does not want to go to Series A funding, the number that are able to build customer growth to a level where they can invest in themselves (approximately 10X growth). Individual success for the program participant is gauged by creation of an international reputation measured through media exposure, and the ability to attract partnerships and speaking engagements. The BIGPush is looking for Canadian acceleration, but also global acceleration for its portfolio companies. According to Zohar, by the time they come out of the program, participants will have achieved significant metrics, KPIs that will allow them to engage in conversations with Series A investors, which in turn will enable them to develop global reach.

Today, The BIGPush is receiving applicants from multiple different sectors, such as fintech and travel. Two noteworthy examples hail from the ‘sharing economy’ space: one is Artery, founded by Salimah Ebrahim, a peer2peer sharing platform for popup cultural showcases that can be held in people’s homes or other interesting spaces, and a second is This Space Works, founded by Lisa Snelgrove, a sharing community that allows larger corporations to share their space with other businesses to create new opportunities. In Zohar’s view, for these pioneers, success will be driven by the founders’ global vision: “its always about the founder” she concluded.

[1] #movethedial, PwC Canada and MaRS (co-authors). Where’s the Dial Now? Benchmark Report 2017. November 2017.

[2] The Bottom Line: Corporate Performance and Women’s Representation on Boards. Catalyst. 2016.

[3] 11 , S. Devillard, T. Vogel, A. Pickersgill, A. Madgavkar, T. Nowski, M. Krishnan, T. Pan, & D. Kechrid. The power of parity: Advancing women’s equality in Canada, executive summary. McKinsey Global Institute, McKinsey & Company Canada. 2017.

[4] Charles M. Davis, Segal Haber, and Mathew Lo. 2015 Global Entrepreneurship Monitor Ontario Report. Brookfield Institute. 2015

[5] Valentina Zarya. Female Founders Got 2% of Venture Capital Dollars in 2017. Fortune. January 2018.

[6] D. Kanze, L. Huang, L., M. A. Conley, & E.T. Higgins. Male and female entrepreneurs get asked different questions by VCs — and it affects how much funding they get. Harvard Business Review. 2017.